Will Insurance Cover Leaking Roof? 5 Essential Tips

Will insurance cover leaking roof issues? If you’re a Massachusetts homeowner struggling with this question, the short answer is—sometimes. Understanding whether your home insurance covers roof leaks starts with determining the cause of the damage.

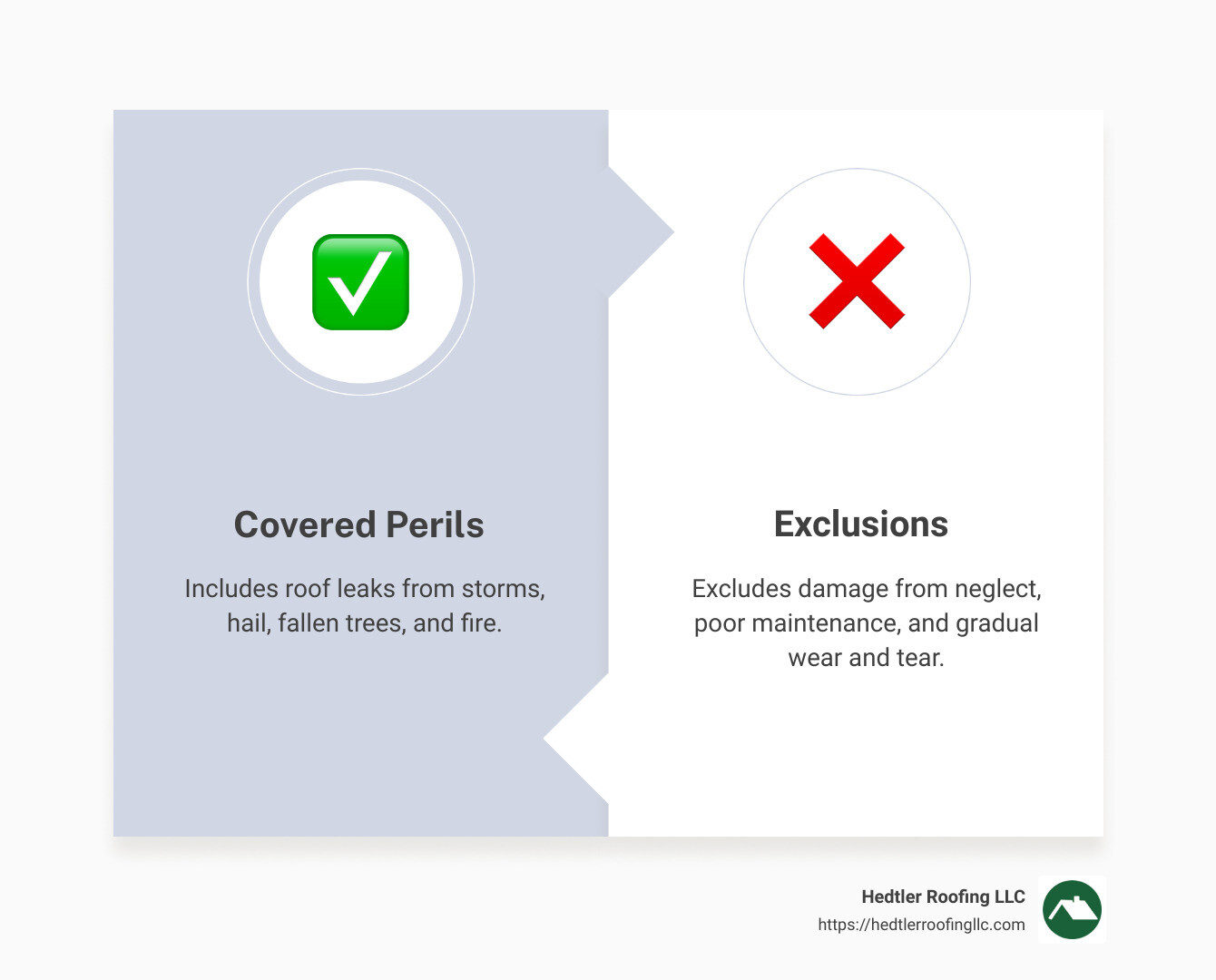

- Covered: Roof leaks from storms, fallen trees, hail, and fire typically qualify for insurance coverage.

- Not Covered: Damage from neglect, poor maintenance, or gradual wear and tear is usually excluded.

Living in Massachusetts, you’re no stranger to harsh weather conditions that can lead to roof leaks. Being well-informed about your insurance policy’s coverage limits is crucial to avoid unexpected costs.

I’m Jason Hedtler, owner of Roof Experts—a trusted name in Massachusetts for over 20 years. With experience in examining how will insurance cover leaking roof issues, my team and I ensure proactive solutions and peace of mind for Massachusetts homeowners.

Will insurance cover leaking roof terms you need:

– ceiling leaking water

– handyman roof repair

– roof flashing repair

What Causes Roof Leaks?

Roof leaks can be a homeowner’s nightmare, especially in Massachusetts where weather can be unpredictable. Understanding the common causes of roof leaks can help you prevent them and know when your insurance might step in.

Storm Damage

Massachusetts is no stranger to severe weather. Storms can bring high winds, heavy rain, and even hail, all of which can wreak havoc on your roof. Shingles can be blown off, and heavy branches can fall, puncturing your roof. These are typically considered “covered perils” in your insurance policy, meaning they are often covered.

Wear and Tear

Over time, roofs naturally deteriorate. Shingles age, flashing corrodes, and materials can become brittle. This gradual wear and tear is a common cause of leaks but is generally not covered by insurance. Homeowners are expected to maintain their roofs to prevent such issues.

Poor Maintenance

Regular maintenance is key to a healthy roof. Neglecting routine checks and repairs can lead to leaks that insurance won’t cover. Simple tasks like cleaning gutters, checking for missing shingles, and ensuring proper ventilation can prevent many leaks.

Accidents

Accidents happen. Whether it’s a stray baseball or a fallen ladder, accidental damage can cause leaks. These situations might be covered by insurance, depending on the specifics of your policy and the nature of the accident.

Being aware of these causes helps you maintain your roof and understand when your insurance might help. Regular inspections and prompt repairs can save you time, money, and stress in the long run.

Will Insurance Cover Leaking Roof?

Understanding if insurance will cover leaking roof issues is crucial for homeowners, especially in Massachusetts, where the weather can be unpredictable. Your insurance coverage largely depends on the cause of the leak and the specifics of your policy.

Covered Perils

Insurance typically covers roof leaks caused by sudden, accidental events. These are known as “covered perils.” Here are some common examples:

- Storms: In Massachusetts, storms can bring high winds, heavy rain, and hail. These elements can damage roofs by tearing off shingles or causing tree branches to fall. If your roof leaks due to storm damage, it’s usually covered by your insurance.

- Fire: If a fire damages your roof and causes leaks, this is generally covered. Fire is a standard peril in most home insurance policies.

- Hail: Hail can cause significant damage to roofing materials, leading to leaks. Most policies cover damage from hail.

- Fallen Trees: When a tree or large branch falls on your roof during a storm, it’s typically covered. The impact can cause immediate damage, leading to leaks.

Exclusions

While insurance covers many sudden events, it often excludes gradual damage or issues that arise from neglect. Here are some common exclusions:

- Wear and Tear: Over time, roofs naturally wear out. Insurance usually does not cover leaks from normal aging or deterioration. Homeowners are responsible for regular maintenance to prevent such issues.

- Neglect: Failing to maintain your roof can lead to leaks that insurance won’t cover. Regular inspections and upkeep are crucial.

- Faulty Workmanship: If your roof leaks due to poor installation or substandard repairs, this is typically not covered. Always hire licensed, reputable contractors to avoid these issues.

- Mold: Mold resulting from a leak is often not covered unless it’s due to a covered peril. Mold can develop from neglected leaks, so addressing water damage promptly is important.

By understanding what your insurance policy covers, you can take proactive steps to maintain your roof and ensure you’re protected when unexpected events occur. Regular inspections and maintenance are key to preventing leaks and avoiding costly repairs.

How to File a Claim for Roof Damage

Filing a claim for roof damage can feel overwhelming, but breaking it down into simple steps can make the process smoother. Here’s how Massachusetts homeowners can steer this process effectively.

Steps to File a Claim

- Identify the Leak Source

Before filing a claim, try to pinpoint the source of the leak. Look for water stains on ceilings or walls, and check your attic for signs of water entry. If safe, inspect the roof for missing shingles or visible damage. Knowing the source will help when you report the issue to your insurance company.

- Document the Damage

Take clear photos of the damage. Capture images of the interior water damage and any visible roof issues. Detailed documentation is crucial for your claim. According to experts, this step can make the claims process smoother and ensure you get the coverage you’re entitled to.

- Contact Your Insurance Company

Once you have your documentation ready, contact your insurance provider promptly. You can often file a claim online, over the phone, or through a mobile app. Quick reporting is essential, especially if the damage is due to a widespread event like a storm.

- Temporary Solutions

While waiting for your claim to be processed, take temporary measures to prevent further damage. Use buckets to catch drips and tarps to cover the damaged roof area. This not only protects your home but also shows your insurer that you’re taking steps to minimize damage.

Choosing a Contractor

Once your claim is underway, you’ll need a reputable contractor to assess and repair the damage. Here’s how to choose one wisely:

- Licensed and Insured

Always hire a contractor who is licensed in Massachusetts. This ensures they meet state standards for knowledge and quality. Check that they have both liability insurance and workers’ compensation. This protects you from potential liabilities if an accident occurs on your property.

- Reputable and Trustworthy

Research potential contractors thoroughly. Look for reviews, ask for references, and verify their past work. A good reputation is a strong indicator of quality service. Avoid contractors who knock on your door after a storm offering suspiciously low rates or unsolicited services. These can often be scams.

- Avoid Scams

After a major storm, some unscrupulous contractors may try to take advantage of homeowners. Be wary of those who offer to handle your insurance claim for you or promise a “free” roof. Stick to contractors you trust and who have a proven track record.

By following these steps, Massachusetts homeowners can ensure their roof damage claims are handled efficiently and effectively. Next, we’ll explore the differences between Actual Cash Value and Replacement Cost Value to help you understand your coverage options better.

Actual Cash Value vs. Replacement Cost Value

When dealing with roof damage, understanding Actual Cash Value (ACV) and Replacement Cost Value (RCV) is crucial for Massachusetts homeowners. These two types of coverage determine how much your insurance will pay for a damaged roof. Let’s break it down.

Actual Cash Value

Actual Cash Value coverage considers depreciation. This means your payout will be reduced based on the age and condition of your roof. For example, if your roof is halfway through its 20-year lifespan, your insurance might only cover half of the replacement costs. This results in a lower payout, which can be a significant financial burden if your roof is older.

Pros:

– Lower premiums compared to RCV.

– Suitable for those looking to save on insurance costs.

Cons:

– Reduced payout due to depreciation.

– May not cover full repair or replacement costs, leaving you with out-of-pocket expenses.

Replacement Cost Value

Replacement Cost Value coverage, on the other hand, pays for a new roof without factoring in depreciation. This means you get the full cost to replace your roof with similar materials. While this option comes with higher premiums, it provides peace of mind knowing your roof can be fully replaced without unexpected expenses.

Pros:

– Full replacement cost covered.

– No depreciation deduction, ensuring you’re not left paying out-of-pocket for a new roof.

Cons:

– Higher premiums than ACV.

– May not be available for very old roofs.

Choosing between ACV and RCV depends on your financial situation and the age of your roof. Homeowners with newer roofs may find RCV more beneficial, while those with older roofs might opt for ACV to save on premiums. Understanding these differences can help you make an informed decision about your will insurance cover leaking roof question.

In the next section, we’ll discuss how regular maintenance and inspections can prevent roof leaks and save you from navigating these coverage complexities.

Preventing Roof Leaks

Keeping your roof in good shape is key to avoiding expensive repairs and insurance headaches. Here are some simple steps Massachusetts homeowners can take to prevent roof leaks.

Regular Inspections

Regular inspections are your first line of defense against leaks. Experts recommend checking your roof at least twice a year, in spring and fall. This helps catch small problems before they become big ones. Look for missing shingles, cracked flashing, or any signs of wear and tear.

Pro Tip: After a storm, check your attic for wet insulation or damp spots. Leaks often show up there first.

Gutter Cleaning

Clean gutters are crucial for a healthy roof. Clogged gutters can cause water to back up and seep under your roof, leading to leaks. Aim to clean them at least twice a year, and more often if you have overhanging trees.

- Clear debris like leaves and twigs.

- Ensure downspouts are directing water away from your home.

Trimming Trees

Overhanging branches can damage your roof and lead to leaks. Trim trees regularly to prevent branches from falling during storms and to reduce debris buildup.

- Keep branches at least 10 feet away from your roof.

- Remove dead limbs that could fall and cause damage.

Attic Checks

Your attic can give you clues about potential roof problems. Check your attic for signs of leaks, like mold, rust, or dampness. Proper ventilation is also important to prevent moisture buildup.

- Look for water stains on beams and insulation.

- Ensure vents are clear and functioning properly.

By focusing on these preventive measures, you can keep your roof in top condition and avoid the stress of dealing with leaks and insurance claims. In the next section, we’ll answer some frequently asked questions about roof leaks and insurance.

Frequently Asked Questions about Roof Leaks and Insurance

How to Make a Successful Water Leak Insurance Claim?

When dealing with a roof leak, the first step is to identify the source. This could be a missing shingle, a cracked flashing, or debris clogging your gutters. Once you’ve pinpointed the issue, it’s crucial to stop the leak temporarily. Use buckets to catch dripping water and cover the affected area with a tarp to prevent further damage.

Document everything. Take clear photos of the damage and note the date and time of the incident. This documentation is essential when contacting your insurance company. Insurance usually covers damage from sudden and accidental events like storms or fallen trees, but not from neglect or wear and tear.

Consider professional help. A roofing expert can provide a detailed assessment and help you with the insurance process. Their expertise ensures that all damage is accounted for and that repairs are done correctly.

Does Homeowners Insurance Cover Ceiling Leaks?

Homeowners insurance might cover ceiling leaks if they’re caused by a covered peril. This includes events like a storm, a sudden burst pipe, or a tree falling on your roof. However, if the leak is due to neglect, wear and tear, or poor maintenance, it usually won’t be covered.

Check your policy for specific exclusions. Some policies exclude damage from mold or faulty workmanship. If your ceiling leak is related to one of these issues, your claim might be denied. It’s always a good idea to review your insurance policy with your agent to understand what is and isn’t covered.

What to Do if a Roof is Leaking During Rain?

If your roof starts leaking during a rainstorm, act quickly to minimize damage. First, move any valuable items out of the way and use buckets or containers to catch the water. This prevents further damage to your floors or furniture.

Next, use a tarp to cover the leaking area on your roof. Ensure the tarp extends at least four feet beyond the damaged area and secure it with nails or fasteners. This temporary solution helps keep more water out until professional repairs can be made.

Finally, dry the area as much as possible. Use towels or a wet vacuum to remove standing water, and set up fans to circulate air and reduce moisture. This step is crucial to prevent mold growth and further structural damage.

Taking these steps can help you manage a roof leak effectively and ensure you’re prepared to handle any insurance claims.

Conclusion

At Roof Experts, we understand the unique needs of Massachusetts homeowners when it comes to roof maintenance and repairs. With over 20 years of experience in the industry, we specialize in providing high-quality roofing services, including installations, replacements, and repairs. Our commitment to excellence ensures that your home is protected from the elements, giving you peace of mind.

Regular roof inspections are a crucial part of maintaining your home’s integrity. They help identify potential issues before they become major problems, saving you time and money in the long run. Our team of experts is dedicated to delivering thorough inspections and detailed reports, ensuring that every aspect of your roof is in optimal condition.

We pride ourselves on our exceptional customer service and workmanship. Whether you’re dealing with a minor leak or need a full roof replacement, our skilled team is here to help. We work closely with you to provide solutions custom to your needs and budget.

For Massachusetts homeowners looking for reliable roofing services, contact Roof Experts for a free inspection or estimate. Experience the difference of working with a trusted partner committed to protecting your home with the highest standards of quality and care.